The prime ski residential property market has moved firmly into positive price growth territory over the last year, despite tourism and travel restrictions. Of the 44 resorts tracked in the Savills Ski Prime Price League, prices grew on average by 5.1% in the last year with some resorts, such as Flims and Grimentz in Switzerland, experience asking price growth of 17%.

Jeremy Rollason, head of Savills Ski, said, “Given the discretionary nature of the asset, only a few resorts such as Val d’Isère, Verbier and Morzine were seeing real price growth up until 2019. That has all changed with virtually all resorts in the Alps and North America experiencing strong double digit and sometimes exponential price growth in a matter of months.

“The first quarter of 2021 was particularly acute for demand. Transaction volumes doubled over the previous year and fierce competition emerged, especially for prime property in the most exclusive resorts. Property that had previously been for sale for a few months—or even years—suddenly found buyers who were keen to escape the confines of towns and cities.”

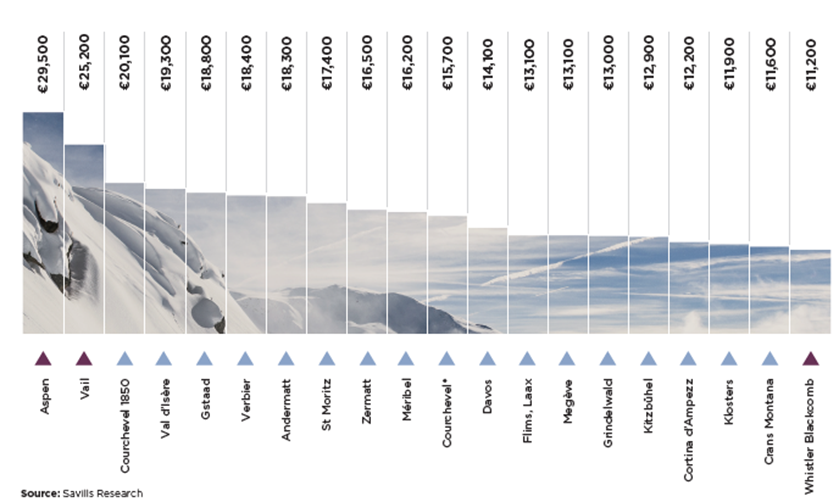

The North American ski resorts of Aspen and Vail top the Savills Ski Prime Price League with Courchevel 1850 moving from the top spot to third place. Aspen, which celebrates its 75th birthday this season, is predominantly a domestic market and prime prices here stand at €29,500 per square metre.

Top 20 prime ski resorts (price per sqm)

Accommodating skiers of all abilities, Méribel has broken into the top ten prime resorts with asking prices of €16,200 per square metre. Boasting 200 lifts and central to the world’s largest ski area, Les Trois Vallées, Méribel has long proved attractive to French and British skiers looking for a dual-season resort.

Skiing is a sport that depends on reliable weather, so stakeholders in the ski industry are acutely aware of the challenges posed by global warming. Savills Ski Resilience Index ranks 61 resorts to determine the quality and reliability of their conditions and their ability to cope with the climate challenges we face.

Zermatt holds the title as the most resilient resort due to its high altitude glacier skiing with a summit of 3,900m. However, this year two new contenders have ascended into the top five, Aspen (USA) and Tignes (France) rank second and third place respectively, thanks to low average temperatures and high levels of snowfall in the 2019/20 season. Conversely, Saas Fee (Switzerland), Breuil- Cervinia (Italy) and Vail (USA) all dropped slightly in the rankings, due to lower levels of snowfall compared to the previous two seasons. The Alps have enjoyed high snowfall over the last three seasons, benefitting Courchevel in particular, which has risen from 44th to 23rd place, thanks to a record 735cm of snow in the 2020/21 season.

When it comes to what buyers want, Switzerland and France are the favoured destinations, with 41% and 39% respectively of our surveyed potential buyers planning to purchase a ski property in either location.

Perhaps unsurprisingly, buyers of ski properties value a good view: some 98% said that this was an important factor in their purchasing decisions. Access to high-speed internet (83%) and some outdoor space (76%) were the next most important factors.

As owners look to make greater use of their ski properties, a dual-season resort is now the most important locational factor for buyers. Convenience is crucial too, with proximity to amenities and ski lifts both key determinants.

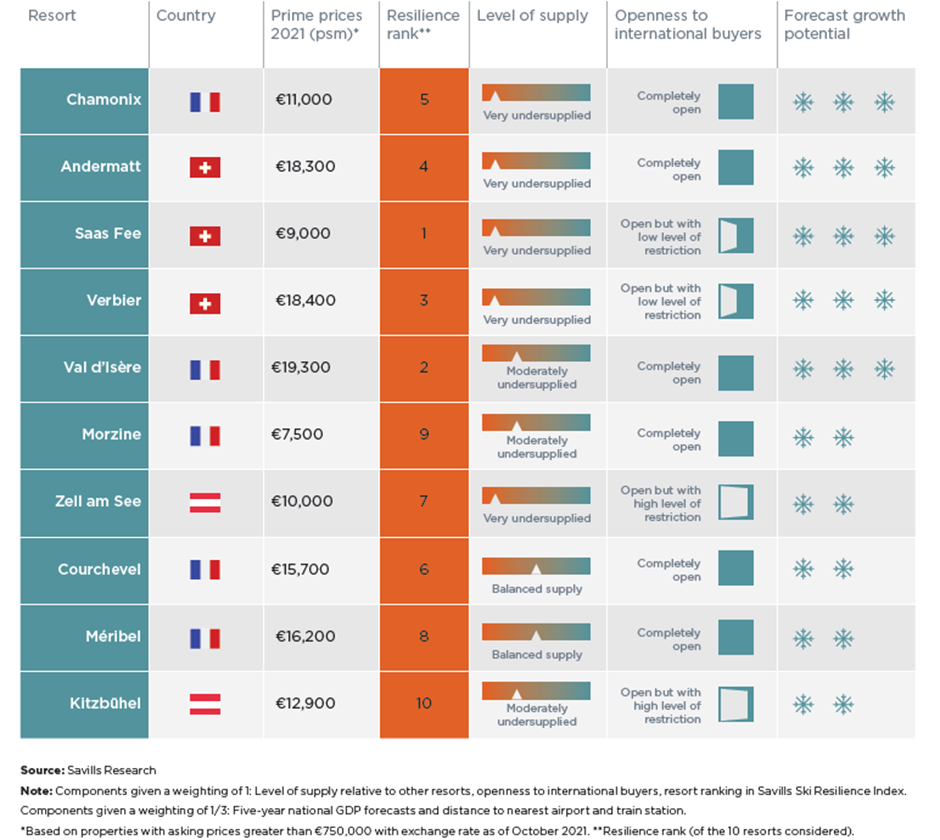

Looking ahead, Savills outlook for 10 prime ski resorts considers the multiplicity of factors that influence price growth.

Lucy Palk, analyst, Savills World Research, adds, “A resort’s supply of property, openness to international buyers, proximity to transport hubs, and the national economic forecast are factors, as is its resilience to climate change. The top four resorts by future growth potential are all characterised by undersupply, with pent-up demand having depleted existing stock.”

In Chamonix, more than 50 apartments are under construction, but with planning restrictions and a limited land bank, future price growth seems inevitable. Future growth potential will increasingly be viewed through the lens of climate change. Those resorts with high altitude, reliably low temperatures and snowfall, such as Saas Fee and Verbier, will be well positioned for growth in the years to come.

Regardless of international travel restrictions, foreign buyers are still keen to purchase ski resort properties and have been quick to return to the property market as restrictions have lifted. The degree to which a resort is open to international buyers is fundamental in diversifying demand. Strong German demand for Austrian resorts such as Kitzbühel are set to trigger future growth for the region.

Prospects for price growth in 10 key resorts